|

It is important to know the severity about using your account to process a transaction for a friend. What do I mean by this? So, let's say you have a friend John that owns a roofing business. John does not have his own merchant account; he calls you up you and ask if you can take a credit card payment for him as a favor. Seems like a win / win situation. You help your friend out and your friend John can take a card from his customer. We all want to be good people in general and want to help our friends out when we can.

Not every situation will be exactly like how I'm describing but you must know that this is considered a form of money laundering. You can lose your services per the card brands and any future processing services you may inquire about in the future with another company. It could also cause issues with the IRS; these are just some of the worst-case scenarios and we want you to be informed. At First Coast Payments we are here to help you should you have questions about this post or anything related to Point-of-Sale systems or credit card processing solutions. Give us a call at 904-638-8804!

0 Comments

Although I work in the payment industry, I too am a consumer of goods and services like everyone else. Since I work in the payments industry, I notice things that the average consumer may not notice.

I am beginning to notice is many businesses have not adapted to the new Visa Rules when a fee is added to a card transaction. In April 2023, Visa made changes to their compliant Surcharging regulations. Non complaint programs using the non-cash adjustment, service fee or some other line-item fee on the credit card receipt will be considered non- compliant Surcharging and may cause a business to be subject to fines by Visa and Mastercard.

If your business charges a cardholder a fee to use a credit card or debit card and your terminal receipts show a fee you may not be compliant with the new rules. Visa is being very aggressive in seeking out businesses that are not in compliant and assessing penalties. This is being accomplished with secret shopper programs and consumer complaints. If your current company has not updated your terminal or your Point of Sale to adhere to the new rules, you should give us a call so we can help you become and stay in are in compliance. At First Coast Payments we are here to help you should you have questions this post or anything related to Point-of-Sale systems or credit card processing solutions. Give us a call at 904-638-8804 You press the 'pay' button, and within a couple of seconds, you receive an order confirmation. It’s a success! That’s the typical way most consumers perceive credit card transactions — essentially, they don’t really think about them at all. Whether it's an in-store, online, unattended, or embedded payment, the behind-the-scenes operations are inconsequential as long as it's simple and functional.

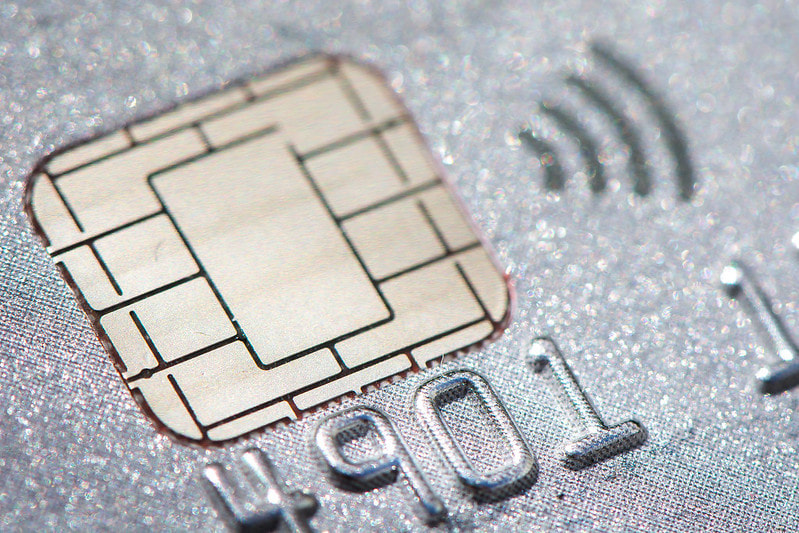

Here is an insight of the journey that a customer's card information, personal data, and funds traverse every time a purchase is made. In the end you will have a better understanding of how credit card payments function and how to enhance the purchasing experience for your customers. The General Path of a Credit Card Payment We'll commence with a broad overview of the processing steps and gradually delve into the details as we progress through the process. Every credit card transaction generally undergoes five primary steps: submission, authorization, authentication, clearing, and settlement. The interface for most consumers is a terminal, point of sale or a payment gateway is like a secret helper during card transactions, handling sensitive card information and sending it to banks for approval. It's crucial for both online and in-store payments. The interface doesn’t just send data—it also protects it. It uses encryption to secure the information. Sometimes, extra security steps like 3DSecure are required before the transaction goes through. Once secured, the interface sends the data to the acquiring bank, the card network, and the customer’s issuing bank. The acquiring bank is the merchant's link, the card network helps with rules and authorization, and the issuing bank evaluates and approves the transaction. It is worth noting that just because there is an approval does not guarantee the card is not fraudulent. Finally, the issuing bank checks for available credit and approves or denies the transaction. The decision is then sent back through the network, and the process, from submission to approval, usually takes seconds. However, for the merchant and the banks, approval isn't the final step. Clearing: Initiating the Movement of Funds The initial stages determine if a transaction can proceed without any exchange of money occurring yet. The movement of funds happens in a separate process, starting when the merchant sends the accepted transaction for clearance. Clearing involves the three parties—acquiring bank, card network, and issuing bank. It begins with merchants batching transactions together for submission. Typically, they send these batches once a day after business hours. These batches are sent to the acquiring bank or payment processors. They can contain hundreds or thousands of transactions, which need to reach the right issuing banks for settlement. To manage this, the acquirer sends the batch to the card network, which sorts and routes each transaction to the respective bank for the final settlement. Settlement: Funds Deposited in the Bank Settlement involves the issuing bank deducting the amount from the cardholder's available credit and sending it to the card network, which transfers the funds to the acquirer. The acquirer then deposits the funds into the seller's merchant account, known as funding or settlement. Unlike authorization that happens in seconds, clearing and funding usually take longer—around two to three business days. This delay, a standard hold in the industry, serves as an extra safety measure to prevent fraud and ensure financial security. While a standard two-day delay is common, some payment processors offer faster funding services, granting brief credit to merchants until the settlement is complete. In Summary The entire payment process involves numerous intricate steps, often without a second thought by most consumers. However, when examined in detail, it's fascinating to comprehend the complexities behind the scenes of processing transactions when one realizes this takes place around 1.86 billion credit card transactions daily. At First Coast Payments , our dedication lies in ensuring that a business will take payments quickly and smoothly so they can focus on their customers. We provide with seamless, cost-effective, and transparent payments, while the business will maximize payment revenues. We are here to help you should you have questions this post or anything related to Point-of-Sale systems or credit card processing solutions. Call First Coast Payments at 904-638-8804!

*Per requirements of the card brands. We are here to help you should you have questions about Best Practices or anything related to Point Of Sale systems or credit card processing solutions. Give us a call at 904-638-8804 We posted back in January 2021 “Protect Your Business Against Disputes and Charge Backs” Click here to view previous post.

Since then we continue to see chargebacks / disputes increasing for all types of merchants. While it’s impossible to avoid charge chargebacks / disputes entirely, the good news is there are simple steps you can take to reduce the number of chargebacks / disputes your business receives and protect your profits. We outline what to do if you receive a chargeback / disputes and the actions you can take to reduce their occurrence. Have you ever noticed it seems like most companies don’t want you to call them? When you go to their website the phone number is almost impossible to find! It would seem that they don’t want their contact number to be located easily. After several maneuvers of verification and hold you finally reach a live customer service individual, only to then be transferred to yet another. The whole endeavor can be most frustrating!⠀

⠀ With our service we are your dedicated contact. We offer white glove service! After your business has been boarded, we continue to support you. We can help you with bank changes, address changes, credit card dispute and more. If you need to talk about your statement we are here to help you and answer your questions. Best of all there are no phone tree to go through. We are available, by phone, email and text. It’s called SERVICE after the sale and we mean it!⠀ As a business there are many things to be careful of when entering into contracts and agreements. Equipment Leasing might be on the top 10 list of shady deals or a Rip Off! Typically this involves a credit card terminal or other devices like a Clover Mini or Clover Flex. It may also be a Point-of-Sale System. These equipment leases are NON CANCELABE for the term of the agreement!

This post is about how many processors use PCI as a way to charge you a fee and increase their revenue.

PCI stands for “payment card industry” and it’s the first half of the acronym PCI-DSS. The second part stands for “data security standards.” While you may see the full term PCI-DSS, it’s more common to see just “PCI.” However, it refers to the same set of standards. Fraud detection should be top of mind for every business, but particularly for those selling online. Start protecting your ecommerce business today with the following easy-to-implement fraud prevention tools and tips.

|

First Coast PAYMENTS BLOGWe eliminate the junk fees others charge. Archives

June 2024

Categories

All

|

Credit Card Processing for small to mid-size businesses. We eliminate the junk fees.

Serving Northeast Florida, including Jacksonville, Fernandina Beach, Yulee, and beyond.

Admin | Privacy

Site powered by eCoalitions.net

First Coast Payments is a registered agent office for several ISO/MSP. Disclosure.

© 2024 First Coast Payments. All Rights Reserved.

Serving Northeast Florida, including Jacksonville, Fernandina Beach, Yulee, and beyond.

Admin | Privacy

Site powered by eCoalitions.net

First Coast Payments is a registered agent office for several ISO/MSP. Disclosure.

© 2024 First Coast Payments. All Rights Reserved.

RSS Feed

RSS Feed